- DeFi Kingdoms Dueling Guide: Something is Better than Nothing - November 4, 2022

- Infinite Fleet Game Overview - October 30, 2022

- Best NFT marketplaces for gamers: All About Those Non-Fungible Tokens - October 9, 2022

The Responsibility Falls On You

The cryptocurrency community is chaotic, relentless, and constantly changing. It’s absorbed other industries into itself and become a part of the global financial institution in a way no one thought possible. When someone says the word ‘crypto’ now, it means much more than just cryptocurrencies. It means NFTs, gaming, DeFi, altcoins, and other peripheral crypto technology.

And the craziest part is that almost none of it is regulated. Governments either allow everything or block everything; few governments have found a way to navigate the cryptographic waters and install protection frameworks for consumers and retail investors alike. Many of the world’s largest governments are only now getting off their asses as they notice the extreme proliferation of this technology. And more importantly, where it’s going in the future.

This lack of oversight is a double-edged sword.

On one hand, what the government don’t know won’t hurt them; if they aren’t watching what’s happening in crypto games, they can’t tax what’s happening in crypto games. If they aren’t monitoring every NFT market, they can’t take a portion of NFT sales. On the other hand, if developers and crypto exchanges know they are free to do as they please, they are far more likely to turn toward corruption and illegality. As we’ve seen time and time again.

The responsibility for evaluating a project’s quality, morality, and sustainability falls on you. The government isn’t going to do it, and you can’t trust the project’s development team since they only want your money.

So who do you trust?

Me. You should trust me.

Who Should You Trust?

Why should you trust me?

Because I’m a dude who’s spent far too much time diving into every web3 game that’s come across my computer screen. Because I’ve learned the hard way who to trust and who not to trust in this financial wild, wild west.

Because I want trustworthy and sustainable projects to be rewarded for their efforts and their counterparts to suffer for their unprofessionalism, and the best way for me to go about this is by telling as many people as possible which projects rock and which don’t.

But as the old saying goes, “Give a man a fish, feed him for a day. Teach a man to fish, feed him for a lifetime.” I don’t want to just give you fish, aka data. I want to teach you to fish, aka do your own research and figure out which project is best for you.

In web3, there’s an acronym you’ll see a lot: DYOR. Do your own research. There are thousands of projects to evaluate, and there’s no possible way I could do them all. So instead, I’ll show you a few basics to keep in mind when conducting your own research on a project.

In the end, you should trust yourself. I will give you all the knowledge necessary so you can trust yourself to make smart, informed decisions.

Key Info Up Front

Four key factors will save you from losing money in web3 gaming.

- Who is building the project?

- What will the project’s economy look like?

- Who gave initial financial backing to the project?

- How engaged is the project in their community?

If you can answer those questions and the answers are good, then you’ve got a winner. Throw some cash at it because that thing will most likely succeed.

Who Is The Development Team?

One of the first questions you should ask yourself when looking at a new crypto project is: who’s behind the project? Is there an artist, intellectual figure, celebrity, or development team? If there is, find them. And if you can’t find them, that’s a big red flag.

Some projects get hyped up because their artist is anonymous or their creator is a mysterious figure that only goes by a single name online and doesn’t have a real face. That hype is only a bubble and it will burst. Those projects with faceless creators and hidden teams are not to be trusted. Because if something were to happen to the project–it gets rugged, the team backs out, they get rekt in the bear market–there’s no one to hold responsible. The people you trusted with your money can just cut and run when things get tough and there’s no recourse for you.

This isn’t a situation you want to find yourself in.

The more names and faces you can put to real people in a project, the better. If there’s a coder or artist that doesn’t want to reveal their identity, that’s more of a red flag for that specific creator, not the project as a whole.

If there’s no public display of who’s behind the project, reach out to the team and ask. Sometimes the people behind the project are very open and honest, they’re just building a lot by themselves and haven’t focused on their public image. But if you ask for some clarification and instead get blocked or ignored? That’s the biggest red flag of all.

Projects should be proud to display their employees and staff. If they aren’t, be careful.

Good Example: Upland

Look at all those bright, smiling faces! That’s what you should see right there. People who are proud of the project they’ve built and want to show it off.

Bad Example: Age of Rust

Who is behind Age of Rust? A company called Spacepirate Games. Who is Spacepirate Games? No idea. Go check out their website, and you’ll find piss poor professionalism. I did some sleuthing to find the Twitter account of the Founder of Spacepirate Games–no name or email–and one of his most recent tweets was a joke about crypto games being rugged. Not a good sign for a crypto game that sure as hell looks like it was rugged.

Who Are The Investors/Financial Backers?

It’s important to know where a project is getting its money from, as that line of credit can either make or break a project’s success.

Is the money coming from a massive, established name in finance, like Blackrock? Or is it coming from a group of NFT bros who call themselves serial investors? One is more likely to survive a bear market and last for decades. The other is far more likely to fail.

Aside from knowing who supplies the money, it’s essential to know who’s holding the reigns of a project.

When web3 projects first launch, they usually offer an ICO (Initial Coin Offering) of some kind. Sometimes it’s a security, sometimes it’s a token, sometimes it’s just a coin. These offers are usually private and allow wealthy investors to snap up vast amounts of a cryptocurrency for shockingly low prices. These offerings decide the majority of the project’s economy. And if the project gives too much of its currency away to these investors, it can disproportionately affect the future sustainability of its economy.

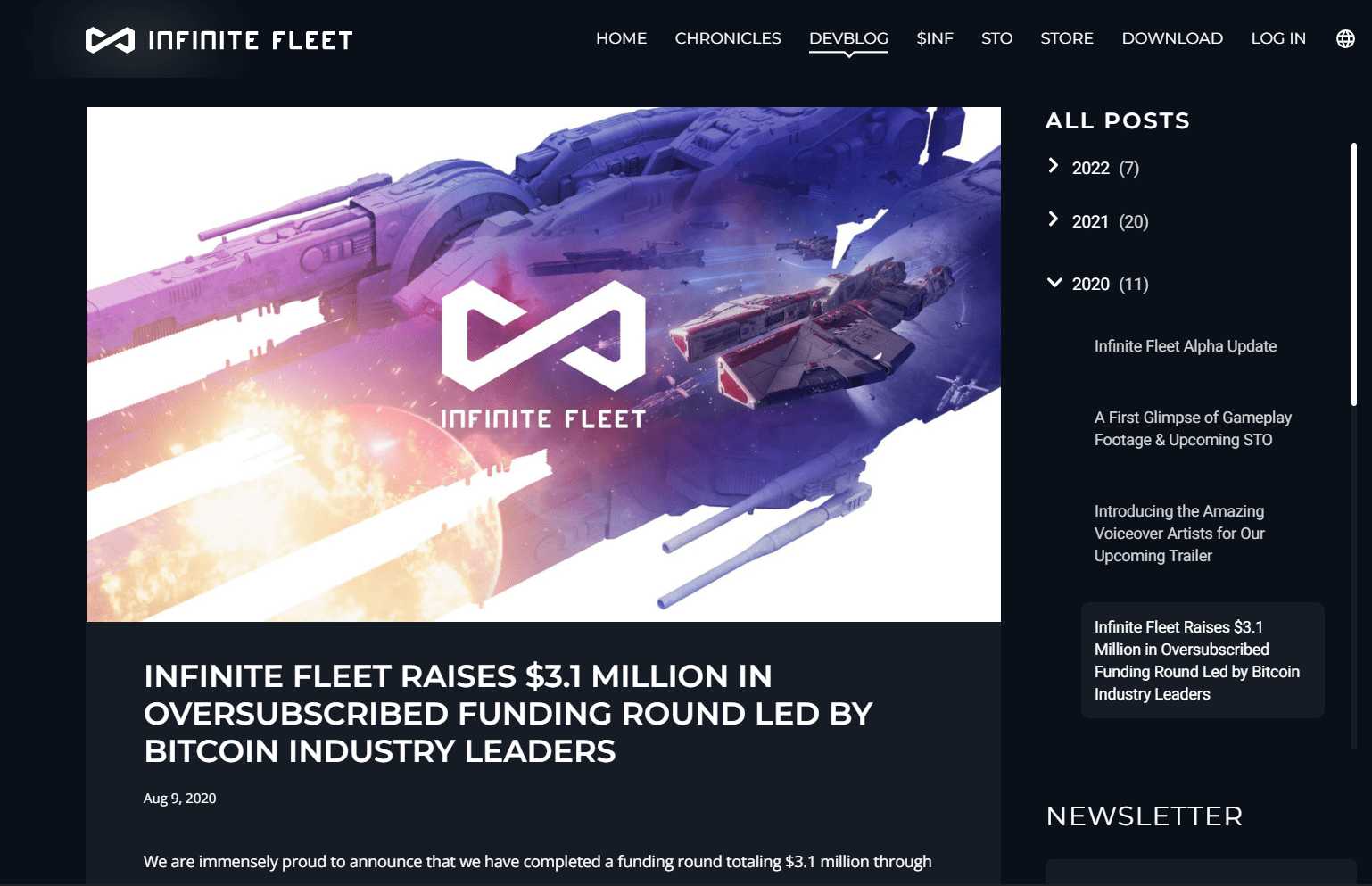

Good Example: Infinite Fleet

Infinite Fleet offered a private security token offering (STO) to anyone holding assets on the liquid blockchain. Though Infinite Fleet isn’t going to display the names of everyone who participated and the amount they bought, they are pointing avid researchers in the right direction. The liquid blockchain is public, anyone can search for wallets associated with it and the token offered by Infinite Fleet, EXO. Cross search the two, look for transactions on or before August 9th, 2020 (when the STO went live), and boom. You’ve got your list of backers.

To save you some time, Infinite Fleet actually published the names of their most prominent backers.

“This exclusive initial round was led by prominent crypto industry leaders such as Charlie Lee (the creator of Litecoin), Adam Back (inventor of HashCash and CEO of Blockstream), and Max Keiser (host of the Keiser Report and founder of Heisenberg Capital).”

Super helpful.

Bad Example: DeFi Kingdoms

As much as I credit DeFi Kingdoms for many things, this is an area they could do a little better. I’m sure the info is out there, buried in the annals of the internet and spread across multiple Medium articles. But it’s hard as hell to find. Infinite Fleet, and even abject failures like Cryptoblades, do a much better job of telling players where their monetary support comes from.

What Are The Project’s Tokenomics?

This is the most daunting part of evaluating a project’s success rate. After all, what the hell are tokenomics?

The combining of token and economics, tokenomics are used to describe the project’s plans for its assets. How are they allocating their reserves of capital, how did they distribute their initial offering to investors, and is there a deflationary measure in place?

You don’t have to be a Harvard-educated economist to evaluate a project’s white paper accurately. Some white papers can be hefty and intimidating. But just start at the beginning and stop at the end. And if there’s anything that doesn’t make sense along the way, look it up.

After you’ve looked at a few white papers, you’ll start to get a sense of good ones and bad ones; ones that have a lot of detail and explain what every cent of their finances looks like, and ones that… don’t.

Here are a couple of buzz words to look out for in economic white papers:

- Inflationary measures?

- Deflationary measures?

- What currency makes up its reserves?

- Do they have a native token?

- Do they have a burning feature?

- What is the total supply of their coin?

- Is their total supply unlocked all at once or over time?

And if these questions don’t make sense, ask for clarification. Head over to the project’s Discord or Twitter, and ask for clarification. On every project’s Discord, there is a channel just for newbies, just for beginners, and just for questions. They welcome the interactions. On Twitter, you might get a more, shall we say, colorful answer to your question. But it’s still illuminating. And Twitter is a great place to eavesdrop on people’s conversations about specific projects.

Good Example: DeFi Kingdoms

Their white paper is about 25 pages long. It’s full to the brim with detailed information about the entirety of their project. It’s good. And if there’s anything missing or you don’t understand in the documents, they have friendly, helpful people everywhere in their Discord. Don’t be afraid to ask a few questions. You’ll usually be rewarded with more info than you wanted.

Bad Example: Cryptoblades

Do you see that? That’s it. That’s all the info on their entire economy.

Do you know what that is? Horseshit. That is unacceptable horseshit.

Community Engagement

Last but certainly not least, community engagement is an important metric for judging a good gaming investment in web3. And thankfully, it’s one of the easiest to figure out. Once again, we will go to Twitter and Discord to explore a bit.

Is the project hosting any giveaways? Are passionate fans posting about the game as much or more than the game themselves? Is the game offering whitelist spots or raffles? How many followers does the project have?

Bots are a constant threat when operating on Twitter, and they’re constantly preying on someone in Discord. So be sure to look for real, authentic users discussing the project. If their social medias have been dark for months, that’s not a good sign. If no one is talking about the game, not a good sign.

A solid way to judge a project’s engagement is simply to join their Discord and shoot out a question in their FAQ channel. How quickly do you get a response? Is the response from a fellow gamer or an official team member?

Giveaways, fan art features, and promotional tweets are all great indicators of a project’s investment in its community.

Good Example: Splinterlands

Splinterlands is excellent in this regard. They host fan art competitions regularly, and they’ve onboarded some fans to help build the lore of their world. Just looking at their tournament page shows they’re invested in keeping their community happy.

Bad Example: Farsite

Farsite is a cool, sci-fi, player-driven NFT game. Its development team is nowhere to be found. When you reach out via Twitter, Discord, and email and get nothing in response, that’s not a good sign. I had a few messages in Discord that sat there for weeks with only fellow players responding in kind. Not a good indicator of community engagement.

FAQs

Question: Is there any web3 game that’s nailed all aspects of a sustainable project?

Answer: That’s a good question. Short answer? No. There are some games that come close. Star Atlas, DeFi Kingdoms, the Sandbox, and just about anything from Gala Games sits squarely above 70% sustainable. In my opinion. Some are in the 90%. But I don’t think there’s any game that’s perfected all aspects of a sustainable economy that benefits its players. Time will tell.

Question: It seems like a lot of time figuring out if a game is good or not. Is this all necessary?

Answer: Hey, if you’ve got money to shotgun blast into all of web3, do your thing. But if you want to make sure you can get your money back out of the games you put them in, DYOR before you invest. If you want to ensure your cash actually grows, DYOR before you invest. If you don’t mind losing money in pursuing knowledge, then shotgun blast it all, my friend.

Question: How do I introduce myself when reaching out for more clarification? Just a curious person?

Answer: Pretty much. If it bothers you, lean into the technicality of your question. You noticed that a piece of information might be missing from their white paper, and you’re merely wondering if it’s listed somewhere else, like in a Medium post or a Discord message. It opens the channel for communication, after which you can pepper more questions at them.

Question: So what you’re saying is I should invest in Crypto Kitties?

Answer: No. That is absolutely not what I’m saying. Use any of the criteria I put forth against Crypto Kitties and you will find yourself looking at a pile of fermented catshit. Remember, DYOR.

In Conclusion

Don’t trust hype people online telling you to buy into a project before it’s too late. Refuse the kool-aid of blindly buying into a project before knowing anything about it. And remember to do your research. It may be time-consuming, a lot of reading, and a little over your head sometimes (it is for me). But it’s time that is well spent making sure your money isn’t being tossed to a scam artist of the digital age.

For more interesting reading check out: